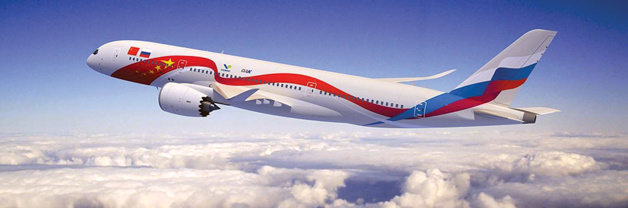

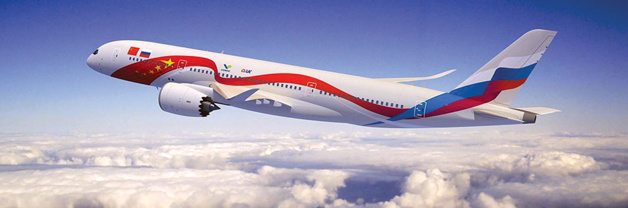

Credit Comac

The Chinese airline sector has been expanding since the 1990s. Many factors can explain this spectacular development: the Chinese civil aviation created three big airline companies in the late 90s (China Airlines, China Southern Airlines and China Eastern Airlines), which allowed an efficient reorganisation of the air transport, while this sector was liberalised by China’s adhesion to the WTO, which galvanized the market. The increasing of the living standards, the urbanisation of the population and the institution of paid leaves are the other reasons explaining the growth of this business sector. The demand for commercial airplanes is so high that Airbus estimates that the People’s Republic of China will become the first consumer of civilian aircraft in 2033, with 6000 planes.

The Middle Empire does not intend to leave the lion’s share to Western companies – especially Boeing and Airbus - in this huge market estimated at 870 billion dollars. However, these two titans of aircraft manufacturing suffer from the growing competition of other more modest but ambitious manufacturers. Thus, while the Canadian Bombardier and the Brazilian Embraer dominate the regional jet market, and while the Russians make a strong comeback with their Sukhoi SSJ 100 and their Irkut MS-21, the Chinese seek their own place under the sun. But even if the Chinese aeronautic industry possesses considerable means, it is not sure to match the European and North American manufacturers, in both the military and civilian domains. The conception, the series construction and the commercialisation of modern airplanes are costly, complex procedures, which require specific industrial resources and a very qualified manpower.

Copy: a long tradition

For many years, Maoist China merely produced copies of foreign aircrafts. Some of these planes, the French helicopter Super Frelon, were copied through reverse engineering, which means they were disassembled to understand their plans and replicate them in series production. For other models - commercial airliners especially - China paid to acquire production licences, authorisations and plans provided to countries or companies in order to manufacture a product designed by a third party. The first mass-produced civilian aircraft in the People’s Republic of China was the Xian Y-7, created from an imported Soviet Antonov 24. Because of the Cultural Revolution, 18 years passed between the retrieval of the An 24 and the first flight of the Y-7. A hundred of these small turboprop planes were produced. A modernised, expanded version, the MA60, has been operating since the 2000s.

The Shanghai Y-10 was a more ambitious program, introduced at the beginning of the 70s. Inspired for the most part by Boeings 707 bought to the United States, the Y-10 took its first flight ten years after the beginning of the program, and was never mass-produced, because of its obsolescence. Facing the failure of this program and the weaknesses of its aeronautic industry, the PRC decided to restrict its activities to the production of licenced foreign planes (as the McDonnell Douglas MD-80 or, more recently, the Airbus A320) and the ordering of other foreign planes.

ARJ: the art of aeronautic recycling

The ARJ-21 was the first landmark on the long way to China’s aeronautic independence. The first prototype took off in March 2008, six years after the beginning of its design process. Though its manufacturer Comac (Commercial Aircraft Corporation of China) assures that this plane was designed with complete independence, even a neophyte would have difficulties to overlook the similarities with the MD-80, which is produced under licence in China. As a matter of fact, it would seem that the equipment provided by the American aircraft manufacturer was used for the production of the ARJ. Though the fuselage and the general design of the latter come from a relatively old plane, the Ukrainian Antonov, for its part, created a modern aircraft, which uses winglets to reduce consumption, like the last generation of Airbus and Boeing.

However, the Xiangfeng, also called Flying Phoenix, met some troubles during its development, especially with the resistance of the wings, which, on many occasions, postponed its certification - which is the compulsory authorisation to fly. Seven long years had to pass after the first flight of the ARJ-21, so that it could finally get the certification. Until now, the Chinese airline companies almost the only ones to order this small regional airliner, which will be able to carry between 78 and 90 passengers and should enter service by the end of the year.

C919: the Chinese challenger

Nevertheless, the world’s second largest economy has no intention to stay confined to the regional jet market. It also aspires to challenge the best sellers of Airbus and Boeing: the A320 and the B737. Those two planes belong to the category of medium-hauls. According to the estimations, this market will amount to 2000 planes in China for the next 20 years. However, the new Comac 919 could challenge the hegemonic position of the two giants of aviation. It offers 174 places at most and can fly in a range of about 5000 km, which will put it in direct competition with the champions of Boeing and Airbus. As its successor, ARJ, the C919 is not free of delays. Its first flight, which should have happened by half 2015, was postponed to the first semester of 2016, while its commissioning, initially planned for 2018, could be delayed of two years. With more than 500 orders, mostly Chinese too, the last creation of Comac has a bright future ahead of it. Even if it will be sold in China first, it could also be exported to Europe, since British Airways and Ryanair both manifested some interest in it.

Comac also launched two programs: the C929 and the C939. The first is a project shared with the Russian company OAK, which could reach its conclusion in ten years or so. This Chinese-Russian twinjet should offer between 250 and 350 seats, but with a relatively weak range of action for a plane of this size. However, the concept could be well suited to the air transport of Chinese passengers, for this population is used to internal flights, inside a country which is twenty times bigger than France. The second project, C939, is still in a preliminary study phase. As a consequence, little information is available. It should be able to carry more than 390 passengers on a long distance. Therefore, it could compete with the Airbus A330 and A350, as well as with the Boeing 777 and 787.

A dawning, yet promising, aeronautic industry

“Boeing and Airbus are grown-up companies. We are still children: we can stumble” revealed a Comac executive to a journalist of L’Expansion in 2014. Indeed, the development of the aeronautic sector of the Middle Empire can be compared to a child’s growth. A child learns from its mistakes and failures, improves step-by-step, while chasing dreams and great short- and long-term ambitions. Thus, after a reflection on the reasons behind the fiasco of the Shanghai Y-10, Beijing launched more modest and reasonable programs. The ARJ-21 uses a cell based on a proven model, as well as a car drawn by a renowned design department. It could be seen as the first step to a wholly Chinese plane, able to provide experience and qualification: two qualities that have been severely lacking, until now, in the industries of this sector. The C919 also benefited from this progress, which is not only essential to the realization of this project, but also to lay the foundations of even more ambitious programs in the future.

In order to fulfil the hope of becoming equal to the great Western aircraft manufacturers, the way is still long and fraught with danger. For example, the execution, by Chinese airline companies, of some important orders for planes will not necessarily mean that these planes will meet international success. The primary reason is that the Chinese state maintains firm control over these orders, while corruption is still endemic. It can reasonably be supposed that the Chinese authorities put pressure on the companies. Then, the exploitation costs of these planes are unknown. Comac reduced the use of composite materials - even though they are being used more often in the Western countries -, which should increase the weight of the plane, and therefore its consumption. This manufacturer does not benefit from any distribution network that could be compared to those of Airbus or Boeing, especially concerning spare parts. In spite of the lower costs, those disadvantages could deter many actors of air transport.

The Chinese are still very dependent on Western engine manufacturers. Indeed, the ARJ-21 is propelled by General Electric CF34 (produced in the United States), while the C919 uses French-American CFM International LEAP. The last obstacle that could thwart Beijing’s ambitions is psychological: the lack of confidence in - or even the fear of - the planes produced by the workshop of the world. Safety is one of the most valuable data in the world of aeronautics. Yet, in the Western world, the “made in China” label does not only symbolise cheap products, but also lack of reliability and dangerousness. Whatever difficulties the Chinese aircraft may encounter to establish itself on the international aviation market, it could still prove even more difficult to earn the trust of the European and North American markets.